And while Vietnam's furniture boom is welcome news for global retailers from the European Union and Japan, who are cashing in on low-priced imports, it could spell more trouble for some U.S. manufacturers.

Indeed, with goods nearly 10 percent cheaper than those made in neighboring China, Vietnam is being courted by U.S. manufacturing and retail executives looking for inexpensive desks, chairs, and household sets made from pine, cajuput or rubber wood.

The socialist republic on the Indochina peninsula and its surging furniture industry has been a cause for concern among other furniture makers, especially those in the United States, where the industry is deteriorating.

U.S. wood-furniture manufacturers, based mainly in the South, have lost more than 30,000 jobs in the last three years, according to the U.S. Department of Labor. The loss is due in large part to a flood of cheap Chinese imports.

With the influx of Vietnamese goods in the last year, furniture makers like St. Louis-based Furniture Brands International Inc., the largest U.S. furniture manufacturer, and La-Z-Boy Inc., based in Monroe, Michigan, have reason to be worried.

Their products are already losing retail floor space to Chinese goods that typically sell for 30 percent less than U.S. furniture. By comparison, Vietnamese-made furniture is 8 percent to 10 percent cheaper than China's, according to Morgan Keegan analyst Laura Champine.

"What you're seeing are U.S. furniture executives all over Vietnamese manufacturers," Champine said.

At the same time, Vietnam's furniture boom would help retailers like Atlanta-based Havertys Furniture Companies Inc., which has been doubling its private-label imported furniture sales on a year-to-year basis, Champine said.

"Their imports to date have come largely from China, but Vietnamese product could conceivably offer an even more compelling value to consumers," she said.

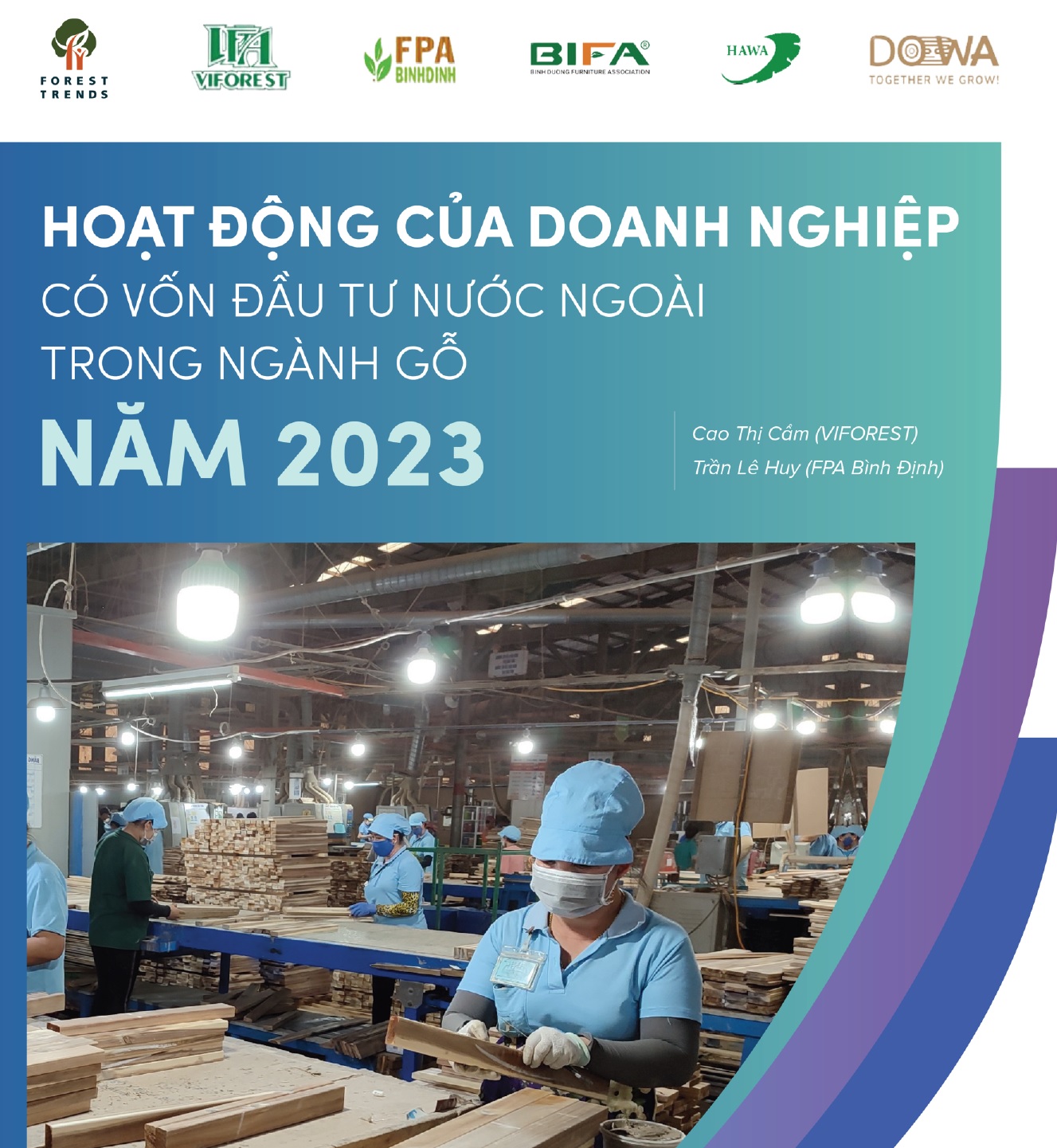

The cost of labor in Vietnam is roughly 20 percent to 40 percent cheaper than in China, allowing Vietnamese furniture makers to offer quality items at lower prices.

And with Chinese-made bedroom furniture facing a possible U.S. tariff this year, analysts and experts believe even more business will head to Vietnam should the tariff pass.

In quantity of shipments, furniture exported by Vietnam to the U.S. still ranks well below that of China, Canada and Mexico. China alone sent $5.6 billion worth of furniture to the U.S. in 2003, according to the International Trade Administration.

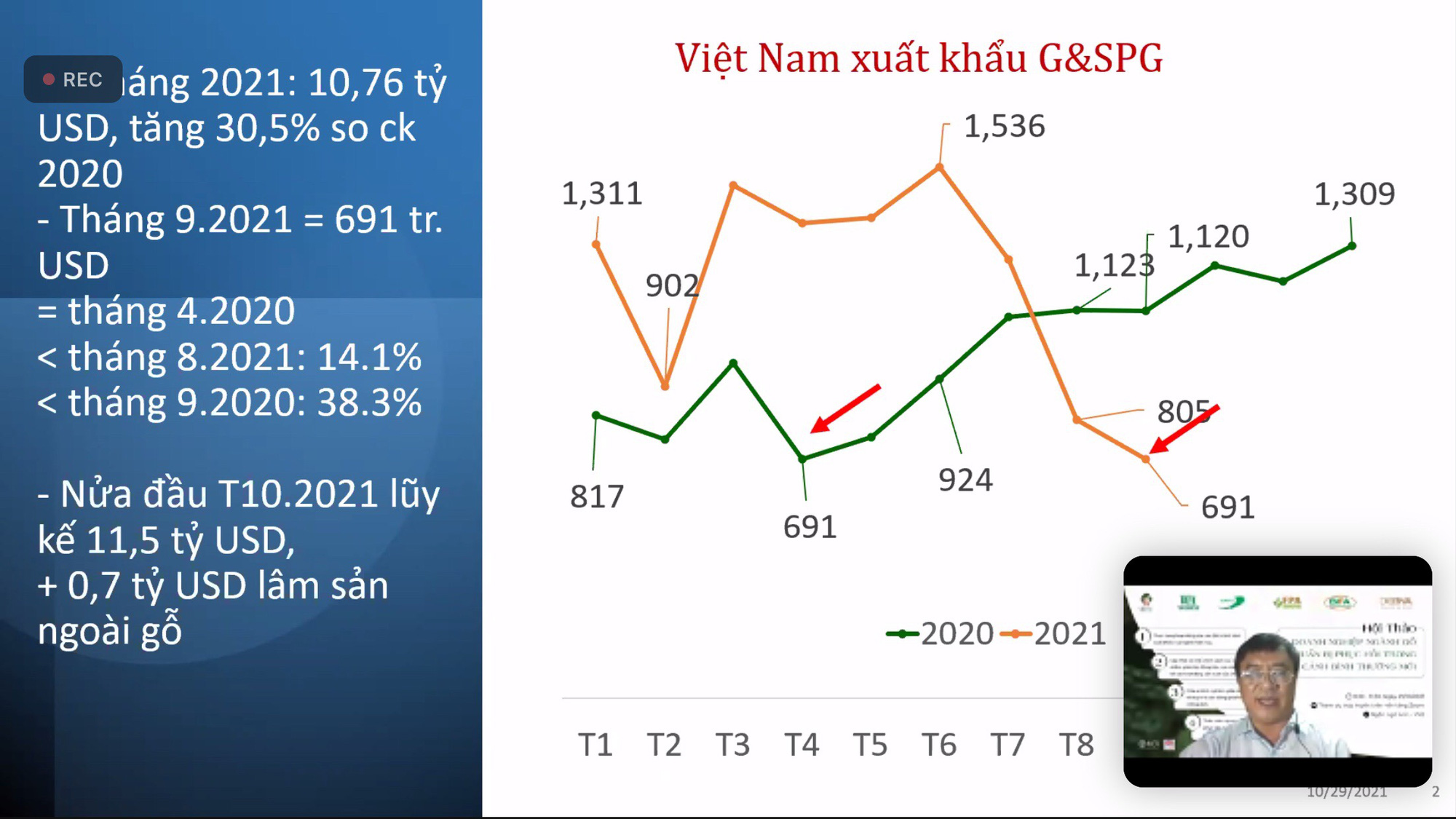

Still, total U.S. furniture imports from Vietnam leaped 155 percent last year to $123.5 million. Of the United States' top 25 importers, the next highest percentage gain last year was Mexico at 35.5 percent.

In February, the Vietnam Ministry of Trade said it expects wooden furniture exports to rise 50 percent to $1 billion by 2005 and will reach $750 million this year.

The U.S. is Vietnam's third-largest importer behind the European Union and Japan, they said.

Last year, the country earned $560 million from furniture exports, a nearly 30 percent increase, the ministry said.

In April, the ministry will make its first-ever appearance at the biannual International Furniture Market in High Point, North Carolina, one of the industry's largest trade shows featuring familiar brands such as Bassett, Broyhill, Sealy and Drexel Heritage.

The ministry's appearance at the market will come just a week before the International Trade Administration is expected to rule on an anti-dumping petition.

In November 2003, 27 U.S. furniture manufacturers and four unions filed the petition to the U.S. government asking for a tariff on Chinese-made bedroom furniture. The group accuses the Chinese of dumping and selling goods at unfairly low prices to the point where it is causing damage to the domestic industry.

But critics of the proposed tariff say taxing Chinese goods will not create U.S. jobs. They say it will merely send more business to places like Vietnam.

"If there is any kind of tariff on China, or its currency inflates," said analyst Keith Hughes of Suntrust Robinson Humphrey, "more and more furniture businesses are going to turn to Vietnam."

By Michael Flaherty (Reuters)

![[Tổng hợp] Những mẹo phong thủy bán đất nhanh không thể bỏ qua](https://bestfurniture.vn/uploads/posts/dat-5-16606959419522402388451.jpg)